What to do if your bank cards get skimmed – Although you may believe it won’t happen to you, the danger of bank card skimming abroad is sadly all too real.

What to do if your bank cards get skimmed

Your bankcard information may be stolen while your cards are inside your wallet, when you use an ATM with a card skimming device installed, or when you make a purchase on a dubious website.

I was dismayed to realise that thousands of dollars had been taken from my bank account in only one day, ten days into a two-month international vacation.

Two other members of my tour group also lost part of their hard-earned cash from their bank accounts over night, so it wasn’t just me.

I discovered my credit card had been disabled on a different trip when someone attempted to use it to purchase a $600 USD airfare.

We’ve all heard horror tales about people using their cards fraudulently, but until it really happens to you, like me, you always assume you’re safe.

Traveling abroad puts you at a far greater risk of fraudulent card usage by those who prey on well-heeled visitors and their desire to often use foreign ATMs and websites, even if it may happen at home as well.

Skip ahead to find out:

- My card skimming experience

- How to protect yourself against credit card fraud

- What to do if your credit cards are skimmed

My card skimming experience

During my travels across Central America, my bank cards were stolen. I was quite cautious while using ATMs, and I never even considered the potential of having my cards compromised while they were in my backpack.

It turns out that two of my cards and the cards of two other persons were skimmed when we crossed the border from Nicaragua into Costa Rica. How am I aware?

All of us carried our cards in our wallets, and not every card that was stolen had been used at an ATM. On the same day, money was illegally withdrawn from each of our accounts.

My card was duplicated and used to make an ATM withdrawal in the Dominican Republic.

In South America, my card was misused a second time. I discovered that a website I used to purchase bus tickets in Argentina had allowed third parties to access my credit card information.

Then, a flight was purchased using the information from my credit card. Fortunately, my bank promptly identified this one and banned my card, preventing the information from being used again.

How to protect yourself against credit card fraud

When you travel, fraudulent card usage is a regular issue, but there are steps you can do to attempt to protect yourself against fraud.

1. Guard your cards.

These RFID-blocking wallets are offered for sale for a reason, as you may have seen at airports and baggage shops. Get one.

Your credit cards, passports, and even driver’s licences use RFID, or radio frequency identification, technology to record personal and card information. You may purchase the necessary hardware online to construct scanners that can read the RFID data on your card.

People who have readers may just approach you and take your information. It’s doubtful that you’ll become aware of it until it’s too late.

RFID-blocking wallets guard against card skimming by blocking the RFID signals on your cards.

You may purchase RFID-blocking cards or sleeves to hold your cards or passport in addition to RFID wallets. To safeguard your cards and passport, I advise you to get at least one of these items. You can get them for as cheap as $7 AUD from places like Kathmandu, Anaconda, or baggage shops.

2. Use ATMs with caution

When utilising ATMs, use caution. First and foremost, utilise ATMs with caution. I make a point of just using ones within banks. Drawing cash inside a bank is also far less noticeable than doing it on the street since they are less vulnerable to theft due to increased bank security (many ATMs have cameras pointed at them).

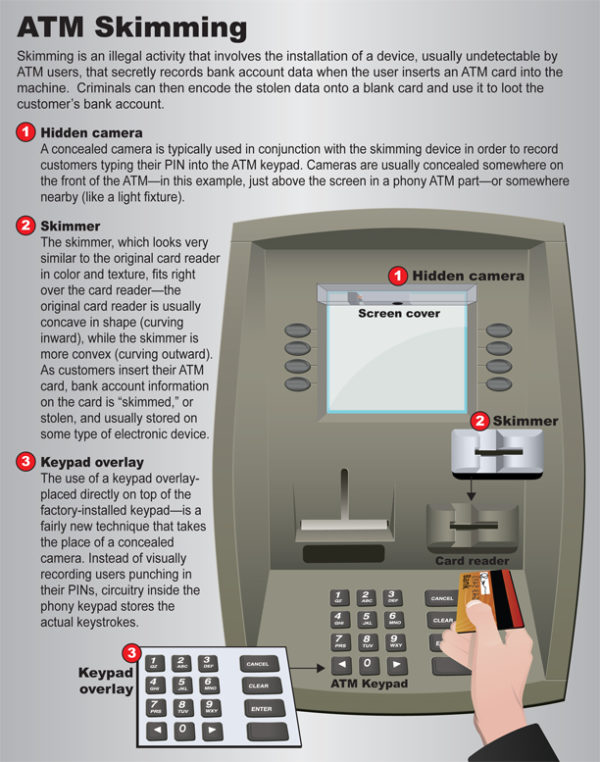

Before using the ATM, give it a close inspection. Are there any indications that it has been altered? Check that the gadget you are inserting your card into cannot be withdrawn simply by looking at it.

In order to leave a heat signature throughout the whole keypad, not just your PIN keys, it’s a good idea to cover the keypad with your hand when entering your PIN and to place your fingers on all of the keys before you leave.

This prevents someone from using a gadget to use the heat signature to figure out your PIN. When using EFTPOS devices abroad, I also use this strategy.

3. Use caution while online

This is a challenging one since you often have to order items like bus or aircraft tickets online and provide your credit card information to complete the transaction. Unfortunately, many websites occasionally lack adequate security safeguards to safeguard your information. Use only trustworthy websites; if in doubt, stay away from them.

4. Maintain a little bank account.

I advise minimising the amount of money in the account that is connected to your cards. This restricts how much money may be taken from your card if it is hacked. When the bank balance falls below a certain amount, you may set up an automated transfer to top up your cards.

Additionally, you want to think about setting a daily credit limit or registering for transaction notifications on your credit card.

What to do if your credit cards are skimmed

Sadly, you may take all of these precautions, encounter some bad luck, and still fall victim to scam. Even though it’s an inconvenience, it’s not the end of the world, and hopefully it won’t prevent you from travelling. Here’s what you should do if it does.

Call your bank.

Banks now attach credit cards with very strong security measures, so it’s probable that they’ll detect fraudulent activity before you do. If your debit card is compromised, you will probably notice it before the banks do. In my situation, I discovered my cards had been skimmed after trying to use an ATM and was told I didn’t have enough money. I dialled my bank right away.

The card will be revoked when you notify your bank of a fraudulent transaction, and you will need to have a new one issued. If you’re on a lengthy trip, this could sometimes be challenging.

Fortunately, I was visiting a friend in Europe soon after my credit card was compromised, so I had my replacement card mailed there. Get the card sent to a trusted friend if at all feasible. It could need you to reschedule your arrangements in order to pick up the card.

In order to attempt to get your money back after cancelling your card, you’ll also need to fill out a document contesting any transactions that aren’t yours. Banks have fraud insurance.

Your bank will look into the questionable transactions once you’ve reported them. Depending on your bank and the circumstances, it might take anywhere from 24 hours to a few months to receive the money returned if it is found that the money was unlawfully obtained.

obtaining cash for emergencies

The first time I was skimmed, con artists stole all the money from both of my cash cards, leaving me with no means to withdraw cash without incurring expensive credit card cash advances.

Since it was the only source of money I had left on me and I might still use it to pay for certain things, including lodging, I didn’t want to leave my credit card anywhere near an ATM just in case.

However, it is simple to have money transmitted to you. My internet connectivity was restricted while I was scammed in Central America, so I requested a friend to send me money using Western Union.

There are further companies that provide money transfers, such MoneyGram. The majority of nations seem to at least have some kind of money transfer organisation. I survived via money transfers while waiting the five weeks for my new cards to come in.

All you need to acquire the cash in the local currency is the transaction reference number and identification, such as a passport. The money is often accessible right away following the transfer. Additionally, there will be a cost for the sender to transmit the money.

If you implement the aforementioned steps, maybe you won’t become a victim of card fraud.

But if it occurs, my practical advice should make it easier for you to deal with the fraudulent usage, acquire access to emergency finances, and recover your money.

Lisa Owen is a petite Australian who lives out her lifelong passion of seeing as many locations as she can. She enjoys sharing her travel tips, photography, and culinary discoveries with others.

She has visited more than 80 countries at last count, all while working in public relations and exploring Australia’s natural beauty.

@thelittleadventurer on Instagram. The Little Adventurer Australia is on Facebook.

The author and others who leave comments are free to have any beliefs, opinions, or positions they want, but they should only be used as a source of travel inspiration.

They don’t represent what Cover-More Insurance thinks.

Always read the PDS provided by your travel insurance provider to verify any activities you engage in are covered by your policy and to understand the limitations, exclusions, and terms of your coverage.

Related Tags: What to do if your bank cards get skimmed